The latest predictions and commentary from Australian property market experts and prominent financial institutions. After reading the latest reports take a few moments to look at earlier forecasts to see who is the most accurate and who can’t forecast within a country mile of the actual market moves. Familiar names do not always translate into a trusted source for your information. Use the facts to make informed decisions.

Source: Livewire / Christopher Joye of Coolabah Capital 2 November 2021

Why Aussie house prices will fall circa 20% when the RBA hikes interest rates. Our central case would be a circa 20 per cent decline after the first 100 basis points of hikes. Read the full article here

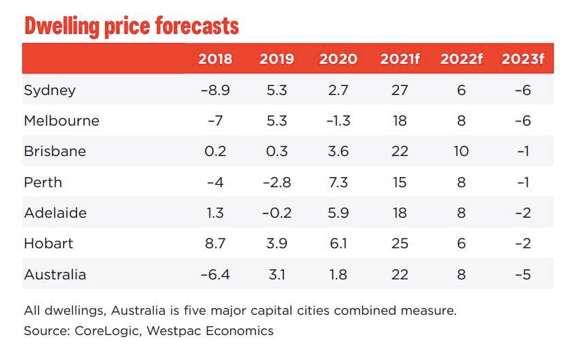

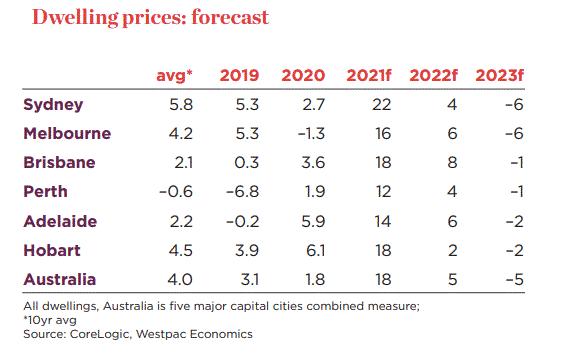

October 2021: Big jumps in WBC forecasting for Sydney at +5% , Hobart + 7% relative to their most recent report a few months ago.

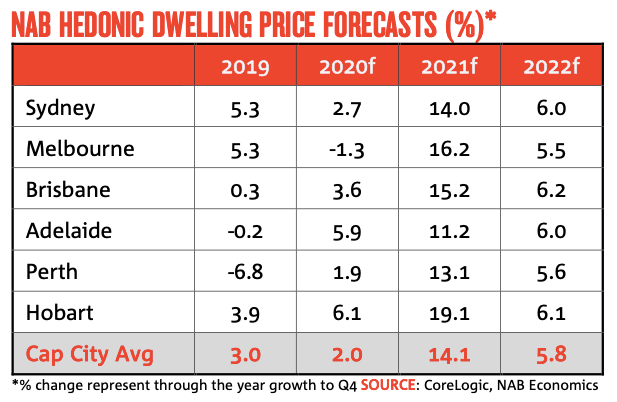

20 October 2021: NAB have significantly revised up (in their Q3 report below) some of their city forecasts for 2021 relative to their Q2 report. Sydney is revised to +27.5% from +21.6 % and Hobart +28.4% from +23.5%

Read the NAB Q3 2021 Residential Property Survey Here.

19 August 2021: Property price forecasts for the rest of the year by Michael Matusik. “There is a clear relationship — a causation not a correlation — between the annual change in housing finance (when brought forward by six months) and the annual movement in house prices”. Read the full report here.

29 July 2021: Westpac’s Chief Economist, Bill Evans, has predicted an 18% rise in house prices, including a 22% rise in Sydney alone. Speaking to AFR, Evans added that the growth would continue until regulators stepped in, which he said would more than likely occur in early 2022. Read more here [Source: Australian Broker]

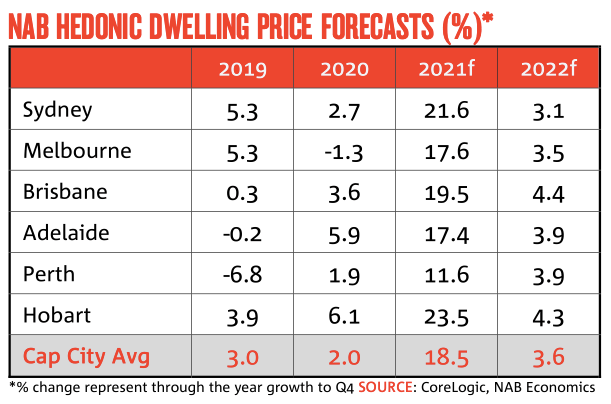

Read the NAB Q2 2021 Residential Property Survey here

Read the WBC revised outlook for dwelling prices here [courtesy of MacroBusiness]

Read the NAB Q1 2021 Residential Property Survey here

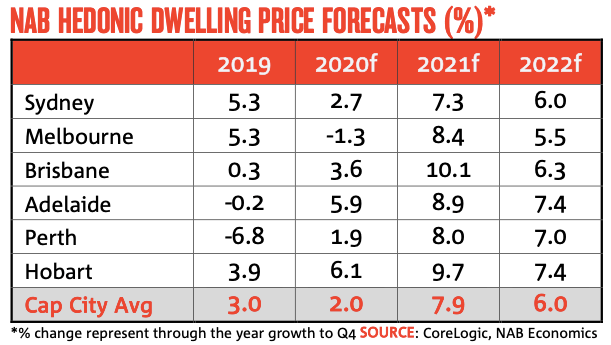

Read the NAB Q4 2020 Residential Property Survey here